Most of us have heard that the secrets to great riches and wealth are:

- OPT – Other People’s Time

- OPM – Other People’s Money

OPT and OPM are found on the right side of the Quadrant. For the most part, people who work on the left side of the Quadrant are the OP (Other People) whose time and money are being used.

Robert Kiyosaki

What can we buy?

Properties are 1 of the best ways to get low interest rate leverage and possibly the best possible form of “Other People Money” for the individual investor.This is my attempt to analysis the potential options.

I started with a million dollar budget and did a property guru search into the possible options and it largely breaks down as such:

- 99years 445 sqft offices that top with a healthy lease of rough 70-80years left , built around 1993

- 99years 126sqft retail shop that top with a healthy lease of rough 70-80years left , built around 1993

- 99years offices that top with a healthy lease of rough 40-70years left , built before 1993

- 40 year lease hold industrial properties

I tried to dig deep on each and i found 40 years lease hold properties have too much of rental depreciation,126sqtft retails are mostly situated inone not too popular areas thus vancany rates should be relatively high. I decided to focus in on offices…

The Local guides

As i made my decision i like to look at the more popular investor coaches and try to breakdown what the path they took to success. I found 3 commercial investor coaches and i broke down their recommendation as such.

But before heading to the other investment coaches i like to give a spot light to the OG of property investing coach in Singapore, Property Soul -Vina Ip or the auntie investor. I have been avid fan and have read all her books and atteneded some of her courses. Something that always stuck with me is to be discerning about the advices as everyone will have their agendas. Most investor coaches are out to make money and everyone attempts to sell their secret sauce, this in itself isnt wrong you dont expect good advice to come cheap. It is up to the individual investor to “separate the fool’s gold from the real gold”.

One thing is for certain, if your investor coach stand to gain from recommending properties to you , its an obviously bad deal and run away as fast as you can!

Highly recommended book for any property investors.

https://arcus-www.amazon.sg/Behind-Scenes-Property-Market-Vina/dp/9811481652

Eric Chew – Singapore Offices

– International Plaza ( own office use for saving rental)

– Shenton house ( enbloc but didnt go through)

– Parkway center ( enrichment classes , upcoming marine parade mrt)

– Peninsula plaza ( small size at same psf , undervalued reason)

Invest With Pete

– 4 Industrial Properties with short 40 year lease.

– Subsequently went to UK instead

Invest with pete has very good breakdown of the uk investment and overall i like his advices, but I tune out when any properties are recommended by him because getting any properties from Investor Coach is a no go for me. Personally I am getting into the uk market as well, as pete described , you can get a 250 years leasehold unit at a much smaller capital of 400kSGD for a 2bedder. Uk also have a good population growth and sensible taxes , there no hefty ABSD !

I-quadrant

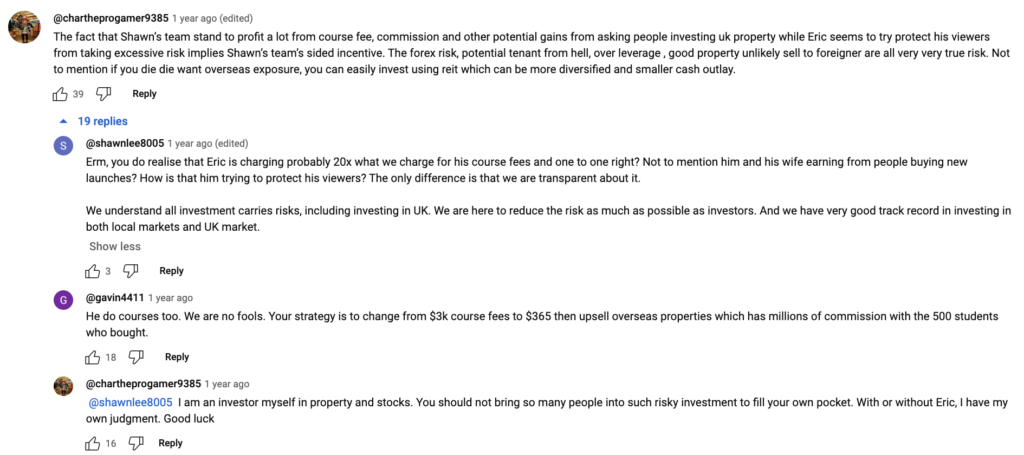

Similar to Pete, they also recommend the UK but one difference is they do get commissions from the property purchases that recommended to you. Would u trust advice of the sales agent , sound like a fool errands. Also with taglines like Little to No Money Down and general advise to leverage to the tits ( 90% loan or 120%loan???) , i worry for the common consumers that follow their advice.

The following comment and discourse in one of iQuadrant Youtube video reflect my own view.

What are the options that we can buy Singapore Office Properties?

As i attempt to understand the office asset, i think it is always important to start with the tenant profile. Who are they? Why are they trying to get and office? What are important and redflags for the tenant?

Why do entrepreneurs get an office and how does WFH reduce drastically the need for the office space. The most important reasons are for meeting clients, meeting rooms to spur collaborative work. The office thus should be close to MRT and accessible. Windows bright lit room and being able to partition large meeting room sizes are important.

If the office size is too small does it make sense still?

There is many alternatives to offices thus accessibly is extremely important.

International Plaza –

– The tenant profilt: Lawyer Offices , Investment Asset Managers.

– Its central location to tanjong pager and proximity to mrt!

Valuation wise:

SunShine Plaza-

Conclusion

Frankly im cluesses about offices asset and many on the ground work is required before i would even think about it.

It remain outside of my circle of competence.

Looking at the rental yield of 3% it make no sense for me right now, i will only consider when its gross 7% at least.

I will move my attention to take a look into the UK property Investment scene instead.