Introduction

Vinaseed HOSE: NSC

Vietnam National Seed Corporation (Vinaseed) began in 1968 as a state-owned enterprise. It started its journey to with a mission to help local Vietnamese farmers with better seed research, agricuature tech and also branding and sales network. This allowed for the industrialisation of small mom & pop farmers.

Understanding the Business Model

Vinaseed has 2 main business lines.

- Selling of hybrid and GMO crop seeds

- Post harvest processing and selling of branded products.

1. Selling of hybrid and GMO crop seeds

Vinaseed concentrates its efforts on research and development of seed varieties.

– 70% of its revenue comes from rice seeds.

– 8% from corn seeds

– 20% from agriculture variety ( Melons, Tomato , watermelon …)

– 2% from vegetable

2. Post harvest processing and selling of branded products.

Vinaseed first sells the seeds to independent farmers then collect the produces from its network of farms around vietnam.

Products are send to vinaseed processing center for post harvest processing and then branded together to be sold as Vietnam branded products.

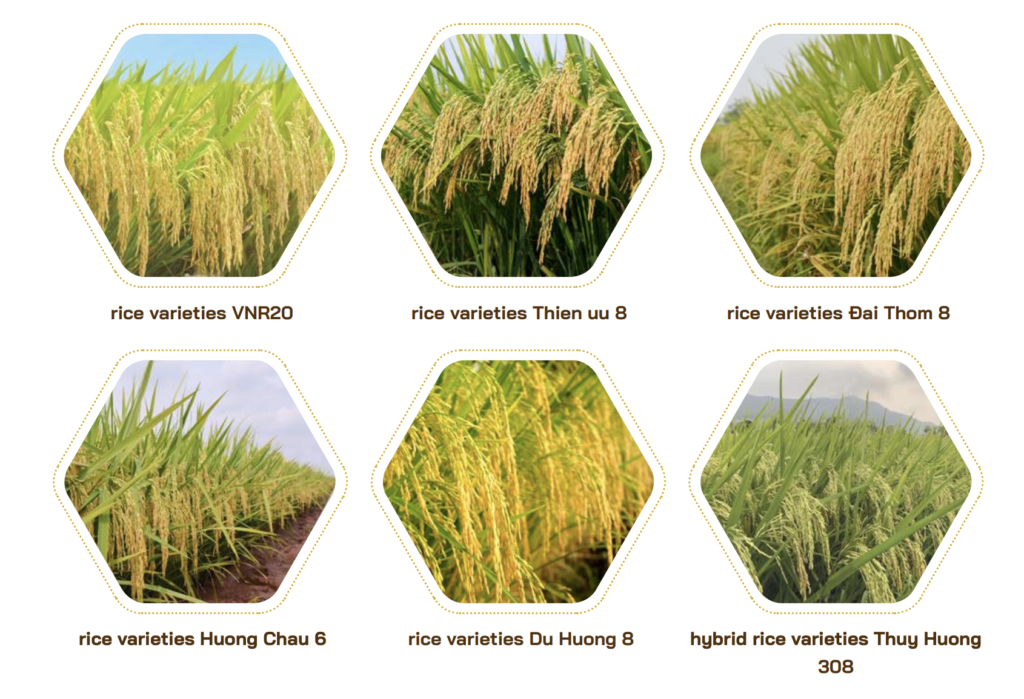

Vinaseed product line

Is this a compelling investment?

Fundamental Breakdown:

1. Increasing Revenues & Earning has grown

Revenues has grown 35mil to 100mil from 2014 to 2023.

2. High Margins

Margins has been decreasing but gradually. As economical of scale are achieved company will be able to sell at a cheaper price.

This net margins remains at a high 13% to 17%.

3. Low debt

Debt has been suprisingly low at 25% debt to equity for such a large capex operation.

4. No sharedilution.

5. Good Dividend payer with a healthy 56% payout ratio

Business Moats ( 3.8/5 )

- Switching Cost & Network Effect

Cropseeds are often a very important selection for farmers, this impacts the next few months and the outcome of the harvest.

The cropseed market is likely to be filled with alternatives, thus farmers will be able to choose from many different varieties.

In order to be part of the branding and network of Vinaseed however, the company will require farmers to grow their developed seeds, vinaseed will also have to take on a more handson approach to ensure the sites are well matained and run according to their standards.

In certain cases, Hybrid seeds such as seedless watermelon will require farmers to rely on seed companies, this creates some form of recurring revenue. - Economies of Scale

As one of the leaders in both Rice seeds and Corn seeds in the vietnam market. Vinaseeds owns about 20% of the market share. It also has a network of processing plants littered around vietnam, this allows for more efficient processing and support of their farmers. - Intangibles

Branding of Japanese Premium Products (eg: VJ pearl rice) .

Replication of Seed.

Risk

- Competitive Threats.

Rice Seed Market is a fragmented market , with competitions from many countries China- 30%, India -21% , Indonesia, Bangladesh, Vietnam and Thailand. The partnership with a japanese market does provide and edge for vinaseed for premium rice.

https://www.prnewswire.com/news-releases/global-rice-seed-market-2017-2022-key-players-are-syngenta-bayer-cropscience-ag-monsanto-company-longping-high-tech–sl-agritech-300521038.html

The Branded Rice Category

The thais has been long known for having the best rice brands but recent reports has shown vietnam has been winning the rice competition race and even thai farmers has been secretly using the cheaper Vietnamese rice variety. Rice is ultimately a commodity and only when branded well , will it be able to be sold as a premium. This will take years to be able to build a reputation like the thais.

https://www.nationthailand.com/thailand/general/40033587

https://www.thaipbsworld.com/thai-rice-varieties-will-no-longer-enter-worlds-best-rice-competition/ - Supply Threats.

Rice will be affected by oversupply and undersupply. The global rice shortage or possibly a reversion to undersupply will occur and investor has to been acutely aware of it.

https://www.cnbc.com/2023/04/19/global-rice-shortage-is-set-to-be-the-largest-in-20-years-heres-why.html - Regulation

To due with inflation, export bans such as india bans or its subsequent reopening will have an effect of rice prices. The protection of the authenticity of thai rice and thai brands , the thai govt has regulation in place to prevent vinaseeds from entering. - Customer

This is a consumer staple and demand will most certainly be there.

Valuation

PE : 6.5

EV/EBIT: 5.7

PB : 1.0

5yrs PE Range: 12.3 – 5

5yrs EV/Ebit Range: 12 – 4

5yrs PB Range: 1.9 – 0.9

MarketCap is back at 2020 levels.

Valuation looks compelling for a long term investor, with a dividend yield of 12% – 5% it looks attractive.

Conclusion

The Investment is a Buy and i started a position in this as part of my exposure into vietnam.

Other Resources.

If you are interested here are a couple more videos to understand how a seed company work in detail.

Annual report

https://storage.vinaseed.com.vn/Data/2022/06/18/annual-report-2021-637911107036054139.pdf