Investment Thesis – BUY

- 75% below it’s peak prices .

- Zero debt , selling below asset values

- 50 years history , economy of scale

- Good dividend payer

Introduction:

In the ever-evolving landscape of apparel retail, Goldlion is a 55-year-old retailer, that has distrubution network, retail stores across China, Hongkong & Singapore. Goldlion, “A man’s world” is known for its workwear, shoes, and business attires. It target the urban man , apart from work attire it also has jacket and wallet and more.

Backing the Investment Thesis:

1. The Sector Rotation.

Sector rotation is like adjusting your sails to the changing winds of the economy. As business cycles evolve through Recovery, Boom, Slow, and Bust phases, different sectors take the spotlight.

- Recovery Phase: Invest in tech, consumer discretionary, and industrials.

- Boom Phase: Favor financials, materials, and energy for potential high returns.

- Slow Phase: Defensive sectors like utilities, healthcare, and consumer staples offer stability.

- Bust Phase: Revert to safe-haven assets in utilities, healthcare, and consumer staples.

Unlike the western countries, China is experiencing or experienced late stage bust phase and is heading towards recovery phase.

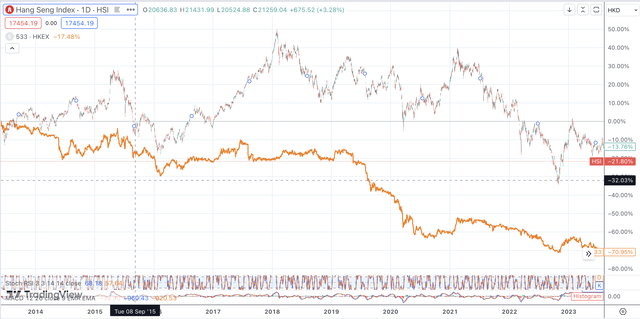

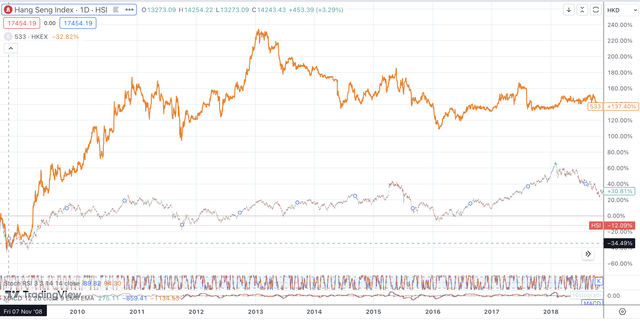

There are reports from my friends that visited hongkong that the tide is shifting on the ground. People are starting to travel , spending more money on coffee , food. The recovery is starting yet quietly. Goldlion – China Apparel Retailer has massively underperformed as china went through its bust phase. A whooping -75% share price drop since 2014

Looking back at 2008. Goldlion similar massively underperformed in 2008 dropping 61% but once recovery started it entered a multi decade long growth phase and massively over performed by 137% points.

2. Sector Analysis:

- The fast fashion industry is notorious for quick rises and falls.

- Successful companies navigate changing consumer demands and invest in robust advertising.

- Companies have to designs & produce six months if consumers decide it not attractive , it might run into inventory risk.

Evaluating the Business Moat

Fair Moat (2.5/5):

- Goldlion boasts a reasonable competitive advantage with a 2.5 out of 5 moat rating. While not overwhelming, this indicates a moderate level of protection against market competition.

- Economies of Scale:

- The company leverages economies of scale effectively, being a sizable player in the market. With its massive size and strategic low-cost manufacturing in China, Goldlion enjoys a distinct cost advantage.

- Network Effect:

- Goldlion’s extensive distribution network spanning China and Singapore creates a network effect. This effect implies that as the brand becomes more familiar and widely available, both wholesale and retail channels benefit from a preference for the trusted and recognized Goldlion brand.

- Brand Recognition:

- Goldlion holds recognition as a professional man’s workwear brand, offering quality at a fair price point.

- Brands moat does not seem too strong , people do not seem to flock to goldlion stores due to its brand .

3. Financials:

- Pros:

- 2021 to 2023 Revenue Growth:

- Signs of increasing revenue due to covid recovery but was stop prematurely by china economy property deflationary bust.

- This hints to underlying consumer strength

- Virtually No Debt: Debt/Equity of 1%

- A conservative mangement

- Minimal Share Dilution:

- Shareholders benefit from little to no share dilution, preserving the ownership value and avoiding potential earnings dilution.

- Attractive Dividend Yield at 8.4%:

- Goldlion’s attractive dividend yield with low payout ratio and should be well supported.

- Good Margins

- A healthy 20% and high Tens net operating margins

- 2014-2023 Revenue Decline:

- The decline in revenue over the period from 2014 to 2023… That could be a general decline in consumer brand recognition or it could also be explain by china bad business cycle from 2020 onwards.

- Decreasing Margins:

- Margins are on a slight declining trend but this can be explain by the tough covid retail policies that caused store closure. This coupled with china economic slow down.

- Falling EPS Over the Years:

- EPS has fallen

- Declining Free Cash Flow (FCF):

- The alignment of declining free cash flow with decreasing revenue raises questions about the company’s cash generation efficiency and financial health.

- 2021 to 2023 Revenue Growth:

3. Risks:

- Ongoing challenges include declining margins and revenues since 2014, a hit from the 2020 Covid impact and China store closures,

- Inventory Levels & inventory turn over has been deteriorating , have to keep a close eye to determine if brand value has really diminished.

- There is a 10% revenue from property investments. Although properties are at deep discount and should infact be postives.

- In Hongkong market , small caps stock are occasionally exposed to potential hostile takeover risk. This is when activist business man forced-buyout and common investor are price takers.

4. Catalyst:

- The end of the Covid era and China’s economic recovery could act as a catalyst for Goldlion.

- Signs of revenue improvement in 2022 were halted by China’s economic devaluation, but a rebound is expected with increased demand for workwear as consumers return to work.

Conclusion:

- A cigarette butt like company where assets are priced below value . You get a great distribution network , semi recognisable brand and low debt that will bring comfort to holding the stock

- Have to be on the look out and see if declining margin and revenues still continue over the years ahead . If it doesn’t improve … to reevaluate investment thesis