Many prefer to invest in a high-growth industry, where there’s a lot of sound and fury. Not me. I prefer to invest in a low-growth industry like plastic knives and forks, but only if I can’t find a no-growth industry like funerals. That’s where the biggest winners are developed…

In a no-growth industry, especially one that’s boring and upsets people, there’s no problem with competition. You don’t have to protect your flanks from potential rivals because nobody else is going to be interested.

— Peter Lynch, One Up On Wall Street

Deep Dive into Anxian Yuan Hk: 0922

As par my routine stock screening , i chanced upon the stock Anxian yuan. A company that has great margin , netcash and almost no debt. After finding out it is in the burial and funeral business, i remembered peter lynch quote about funeral being his favourite ten bagger and i knew i struck gold. It was a stock worth digging further and here are my finding.

As Capitalist Pig, mr wonderful best puts it.

Revenue Breakdown

The revenues centers around 3 beautiful cemetery site.

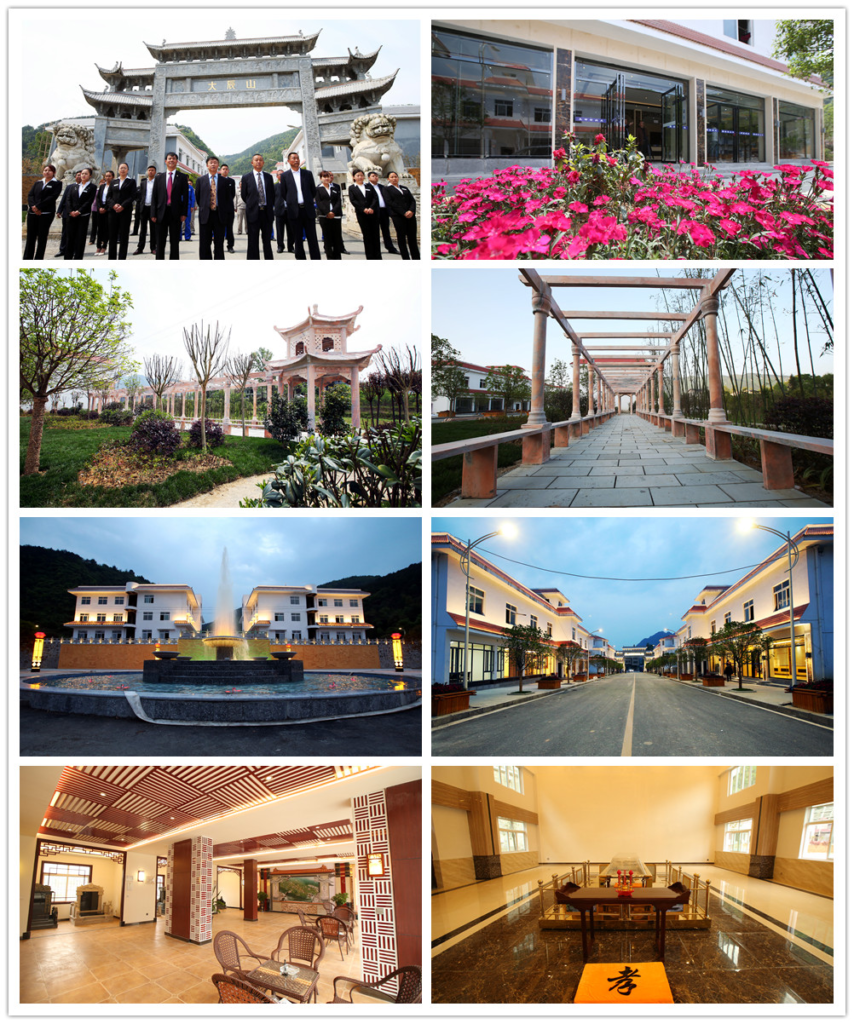

As described in their mission, they plan to ” makes farewell sacred and beautiful! “.

I would think if you are a citizen of a upper middle class chinese family in hangzhuo, this would be a site that you would aspire and feel comfortable to send your love ones too. Price wouldn’t matter, its not surprising the company has a high gross and net profit margins of 75% & 35% .

Cemetery Sites

The company operates from 3 cemetery sites.

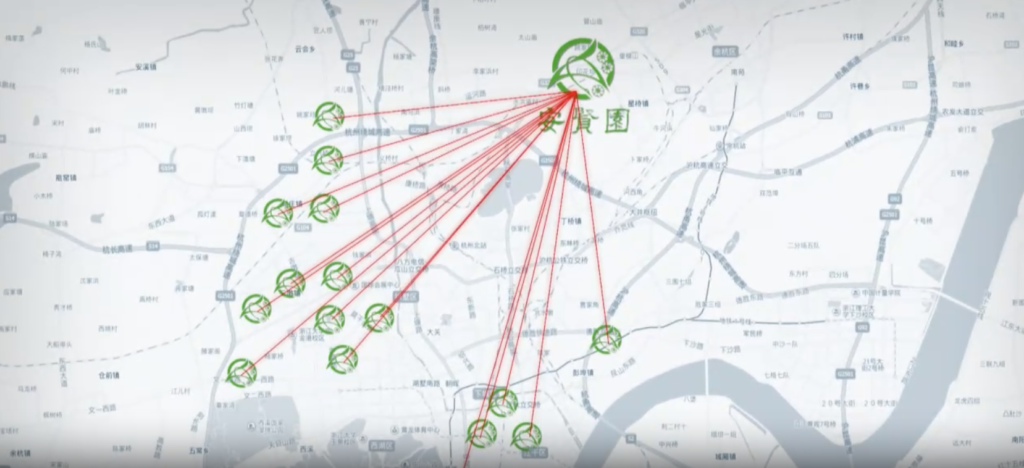

The company generate the revenue from cemetery operations, garden burials to make the sites an attraction or perform funeral related services.

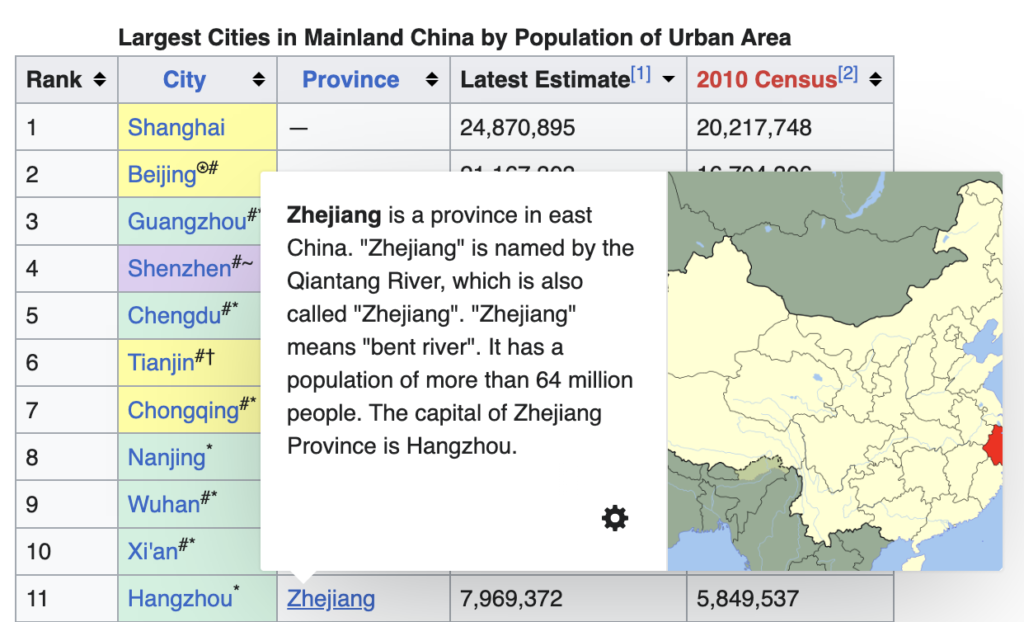

1. Zhejiang Anxian Yuan

Zhejiang is top 11 largest province by population count, with a heatlhy population growth. The need for burial service will most certainly remain high. People normally bury love one close to where they live and in land scarce hangzhuo city, xian an yuan will be a natural place.

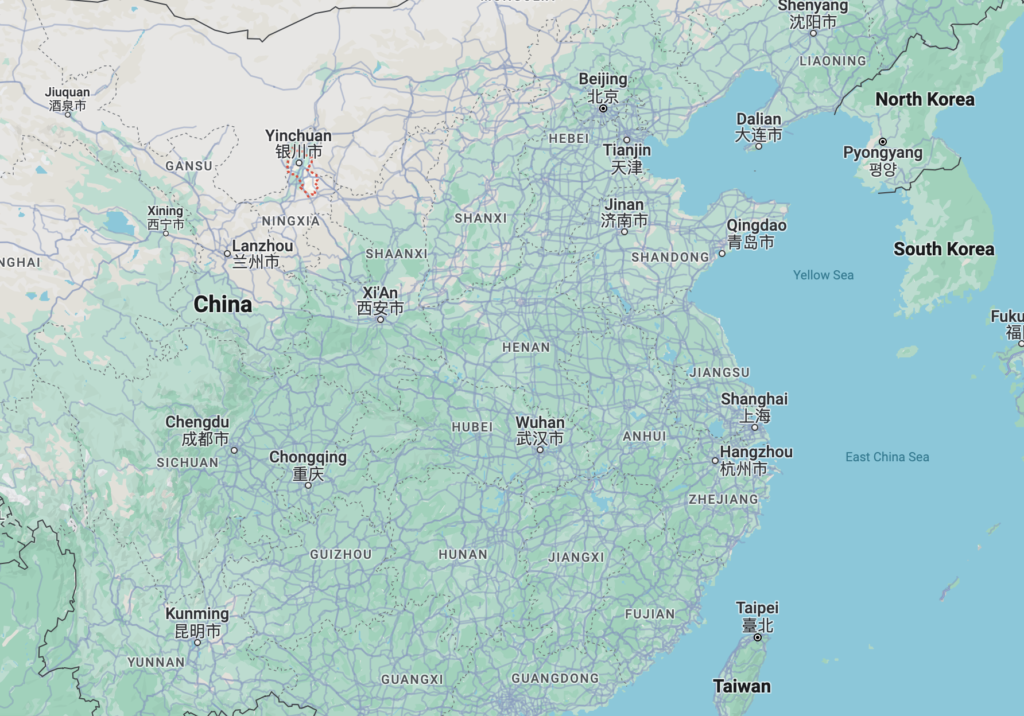

2. Yinchuan Fushouyuan Humanistic Memorial Park

Yinchuan is the capital of the Ningxia Hui Autonomous Region. Yinchuan is a centre for the country’s Hui (Chinese Muslim) minority peoples, who constitutes one-third of the population, and it thus has extensive cultural and economic relations with Islamic countries. It is presently one of china smaller cities. The belt and road initiatives will be impact this area and population growth remains healthy as people tend to mgirate to urban cities. Burial service for the population will still be growing.

3. Zunyi Shixiang Dashenshan Ecological Cemetery

Zunyi Shixiang Dashenshan Ecological Cemetery Co., Ltd. is located in Niuxin Village, Fenghua Town, Suiyang County, Zunyi City, Guizhou Province. The overall area is 1095 acres, 20 kilometers away from Zunyi City, Zunyi Airport, and 5 kilometers away from Suiyang County. The park is surrounded by mountains, with evergreen pines and cypresses, chirping birds and fragrant flowers, beautiful scenery and fresh air.

Garden Burials

The company makes the sites more attractive by including the burial of many notable china heros or including cultural gardens. This is probably to allow families that visit their love ones a place to stay as well as more activities to do.

Business Moats (4/5)

My attempt at analysing the moats of the cemetary business.

- The Network Effect. Its natural for families to be buried together once you get one in the rest of the immediate family should follow.

- Intangible. This is often a closed business where you would need to be able to obtain licenses to get it, obtaining the land plots will also require many government approval. The cemetery business is often a hand me down family business and very rare will there be competition since it is in such a grim industry.

Valuation.

A net cash, low debt company with great margins and good earning growth. The stock is betean down along with most of hongkong stocks right now. It sits at a 0.4x pb and 3.8 pe remarkably lower than its history.

Risk

Covid has caused some surge in its price and we seen it dip down and have stablished. Im unsure if the revenue might reduce but it seems to me the worst of the spike is over.

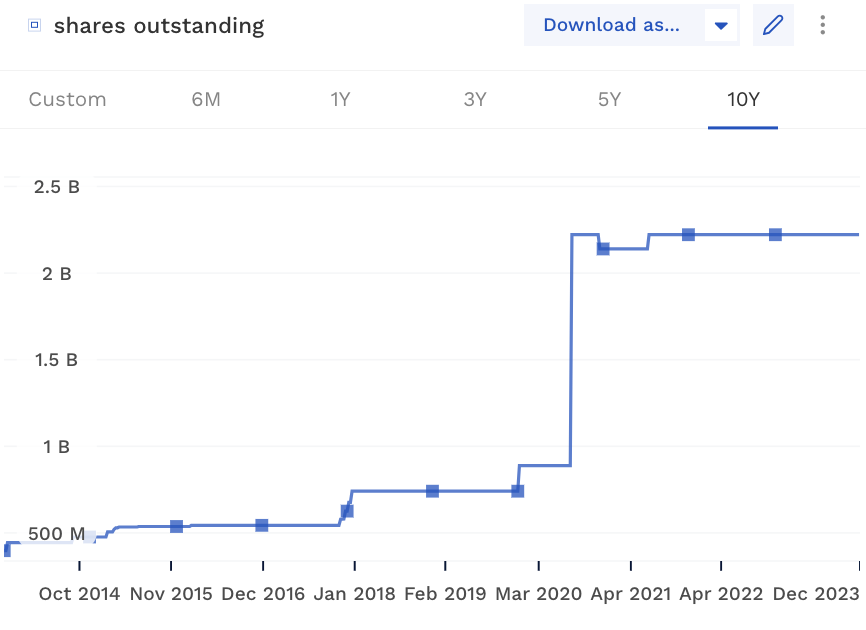

The historic share price has been uninspiring, management has also diluted shareholders quite significantly in the past. It’s concerning but the risk/reward seems about right.

Share dilution in 2018 and share dilution in 2020 is very notable so i dug into the annual reports to find out more.

– Company does employee-stock option plan thus explaining 2018 and 2019 dilution , i dont like that its so significant.

– Also there was a right issue that occured in 2020 . It was most likely used to paydown debt. I am concerned that this occured….

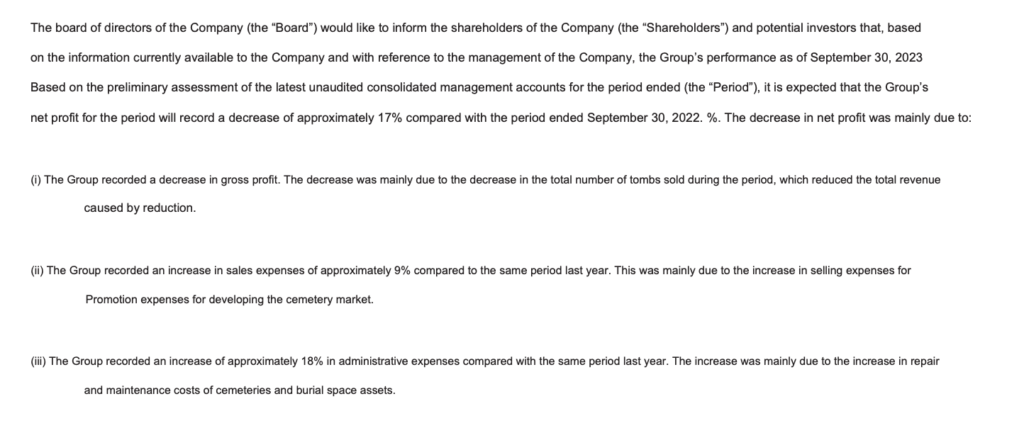

A Profit warning from 2023

– Management highlight in one of their notices of a 17% drop in net profits.

– Happy that management actually highlight this to shareholder , this is a plus for share holders

Conclusion

Its prime real estate.

Anxian Yuan China Holdings Limited is a similar to an undervalued asset play.

I stay on the sidelines and decided to investigate a more mature Grim Repear stock instead Fu Shou Yuan International Group Limited , SEHK:1448.

Note: Please watch with sensitive as the video as people are greiving and i feel very sorry for them, it does give an insight into the cemetary on the ground situation in china.

Useful Resources:

Videos of its sites http://www.anxianyuanchina.com/index.php?g=&m=Index&a=news_video&l=en-us

Breakdown of its revenue: http://www.anxianyuanchina.com/index.php?g=&m=Index&a=operation&l=en-us