Market Update: China Market Recovery

The major news this week was the recovery of the Chinese market. Understandably, China Tech, China Real Estate, and China Large Cap stocks have seen significant revaluations as retail investors began to pump up popular names.

However, China Small Caps have remained less affected by this resurgence. As a heavy investor in China over the past year, I’ve observed a substantial upswing in my portfolio.

I find it interesting that China appears to be starting its transition into a bull market, making it an intriguing area for reentry once a pullback occurs after all the major hype settles down.

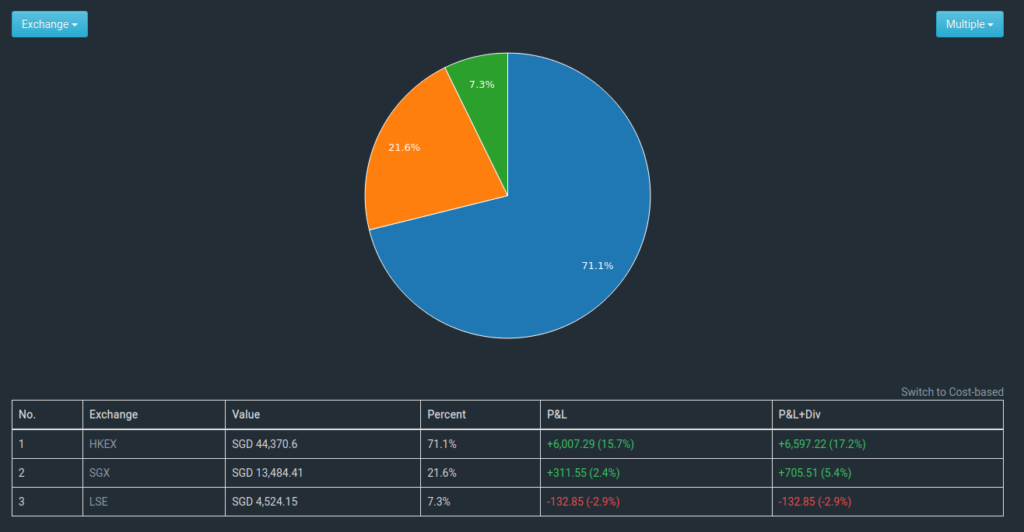

Being 70% invested in Hong Kong stocks wasn’t ideal, but their deep discounted valuations were justifiable. Since the common Hong Kong markets are currently experiencing so much hype, I’ve decided to focus on other markets that seem to be overlooked by the general market.

Here are three stocks I’ve identified as valuable:

Anxian Yuan China Holdings Ltd (SEHK: 922)

A small-cap cemetery operator in China’s Zhejiang province, this is the only second grim reaper listed stock on the Hong Kong exchange. I first wrote about the company back in December 2023.

Here’s a detailed write-up: .

https://angpowinvestor.com/investing-in-grim-repear-stocks-china-burial-services

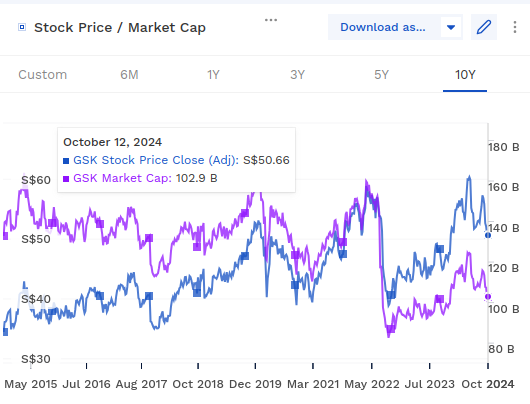

GSK PLC (LSE: GSK)

An undervalued pharma play, GSK is a large company that continually invests in R&D to create new drugs, and these patents can last for decades. While I’m no pharma expert, I believe diversifying into a big-cap pharma company at a good price can represent a solid investment. Pharma stocks are often overlooked because they seem too complicated, which generally provides investors with a good return on capital.

With a current dividend yield of 4%, I am adding it to my portfolio.

Paycom (NYSE: PAYCOM)

Paycom is a hyper-growth payroll software company in the U.S. The payroll software industry is sticky, and Paycom has demonstrated itself to be a long-term growth machine. At a price-to-earnings ratio of 19x right now—down from a previous 198x—it seems compelling at this moment.

Large swings are definitely to be expected with such high-growth stocks, so please invest based on your own risk appetite.