15 Point Checklist

Philip 15 Questions , a quality study rather than a quantitaive one.

Getting to the heart of the business and what makes the business tick?

- Expanding Market! Does the company have the products or services with sufficient market potential to make possible a sizeable increase in sales for at least several years.

- Create New Products! Does the management have a determination to continue to develop products or process that will still further increase total sales potentials when the growth potentials of currently attractive product lines have largely been exploited.

– Apple , Samsung - RND should be Efficient ! How effective are the companu’s R&D in relation to its size ( Large R&D sucks)

- Recurring Sales? Does the company have an above average sales organization ( The making of repeated sales )

– In software its subscription service

– In retail can observe inventory turn over to see if stuff are selling out fast. - Good Margin ! Does the company have a worthwhile margin .

– (10% and above?) - Keeping the Margin? What is the company doing to maintain or improve profit margin

- Does the company have outstanding labor and personnel relations

– ( Nagaworld is a bad example, glass door ? ) - Does the company have outstanding executive relations

– ( Nepotism ? Overpaying Management?) - Does the company have depth to its management?

– No one man shows.,. - How good are the company cost control ? avoid bad cost controls.

- Great Industry Specifics?

- Does the company have long range outlook of profits? ( Strong relationship with suppliers, employees & dont destroy brand with price cut)

- Sharehold dilution in the future? No share dilution in its history is better

- Does the management talk about things freely

- Management has integrity issues? ( Criminal Management or Scandals)

Scuttle-Bud Method

Talking to “Main-Street” resources

- Talking to suppliers, customers, research scientist, trade association or employees.

- Customer Reviews ? GlassDoor Reviews? Competition Reviews?

- Talk to people in the industry.

- Travel , Retail Bloggers?

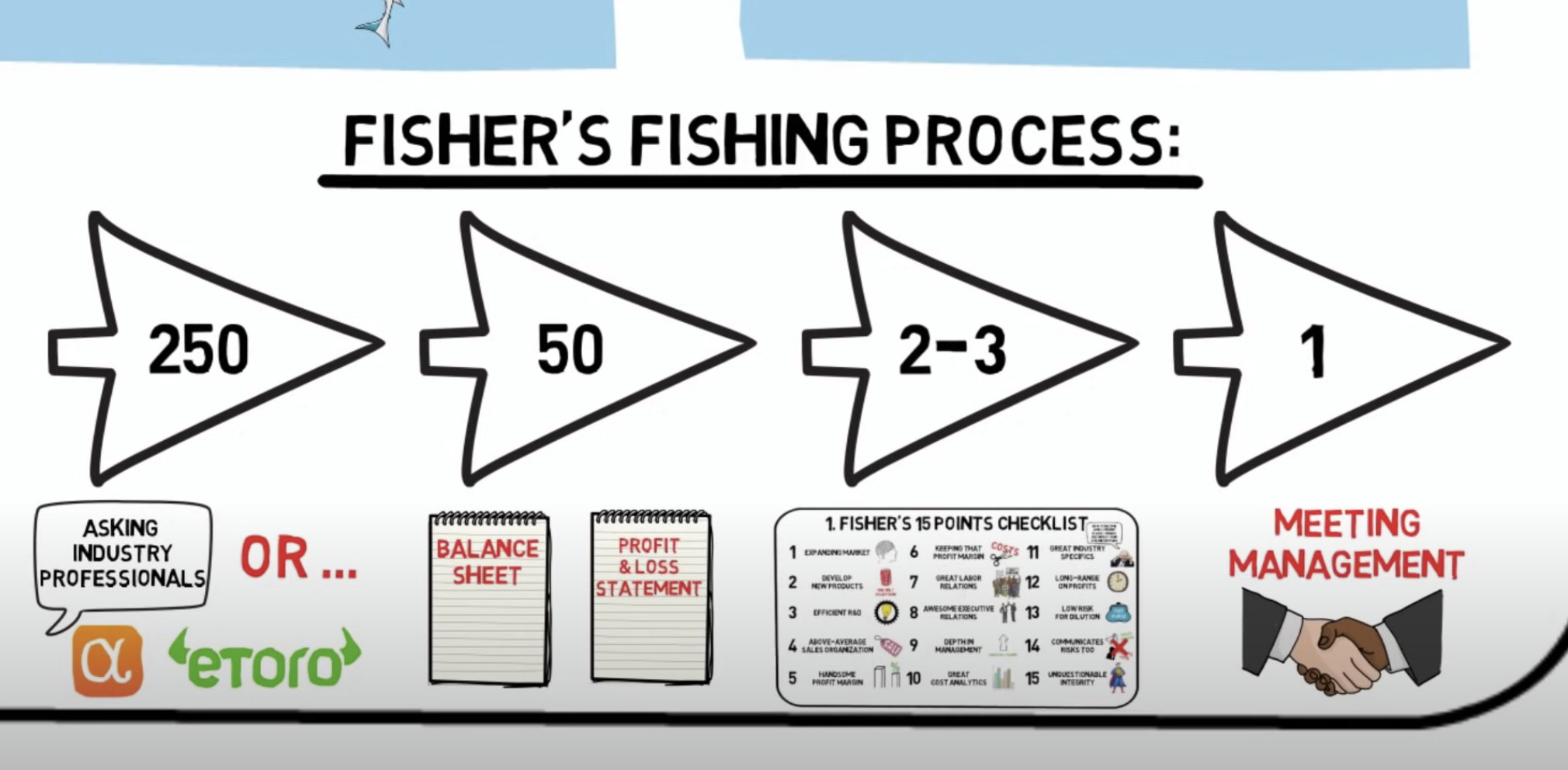

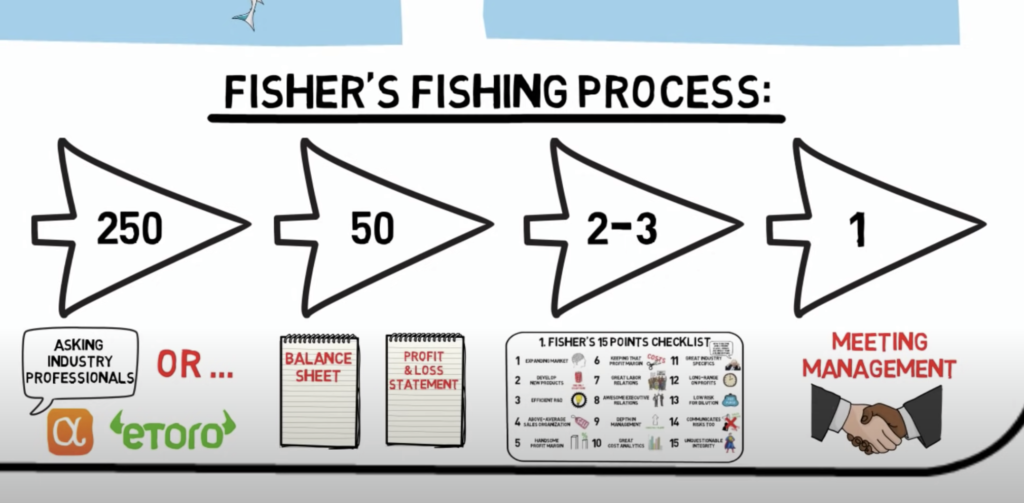

The Fishing Process.

Finding my own fishing process:

- Start with a 1000 Stocks , A Stock Screener ( HK, Malaysia, Uk, Singapore) – filters by fundamentals->

- Filter down to 50 Stocks, A Sector Analysis & Business moat breakdown & Catalyst Study & Valuation ->

- Filter down to 3 stocks-> Management, Insider Buying ->

- Found 1 Stock -> Hook a Fish!