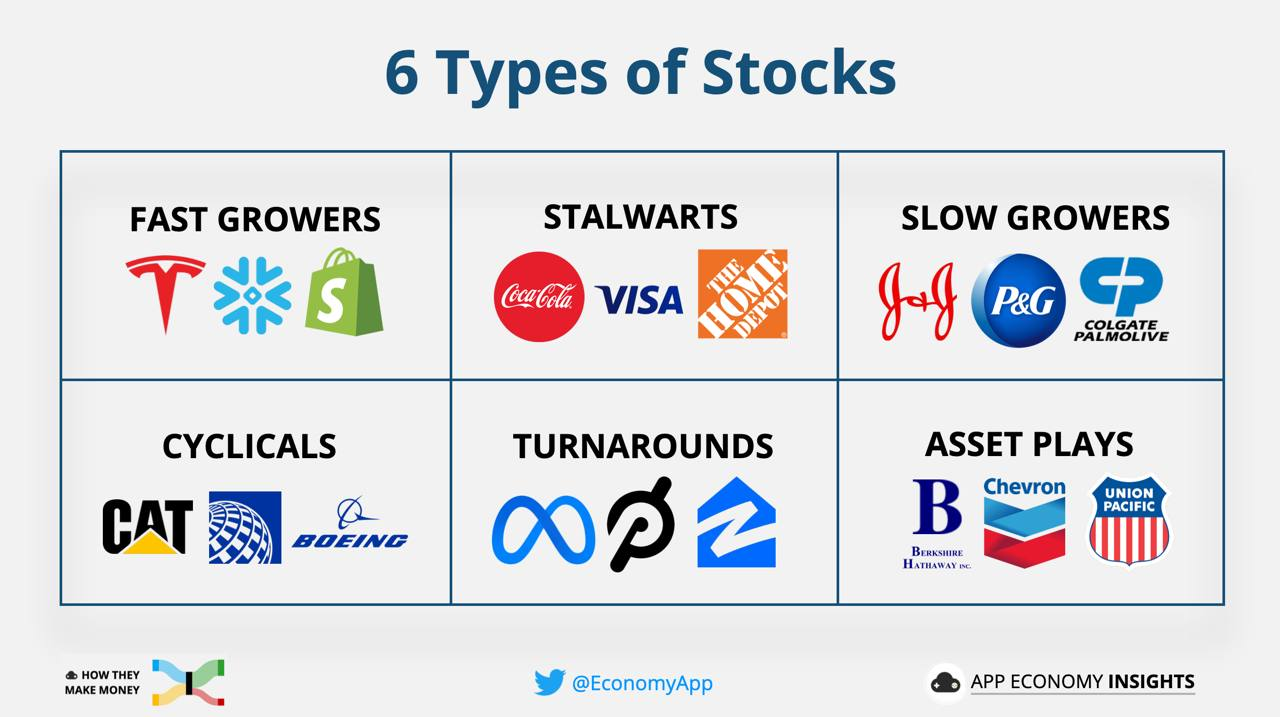

Breaking stocks into categories .

– By understanding the kind of categories , we can attempt to predict future stock earnings.

5 Stock Categories

– Fast Growers

– Stalwarts

– Slow Growers

– Cyclical

– Turnarounds

– Asset Plays

FastGrowers

Buying companies in fast growing industries or fast growing companies in slow industries.

– Companies making aluminium wheels in car industry

– Companies making electric cars.

Stalwarts & Slowgrower

Nothing wrong with getting a slow grower that is very cheaply priced.

If you get pe 5-6 for large established companies , it is almost a no brainer…

– Steady earning growth ( 2-5% )

– Rising dividends ( good sign)

– Room to keep growing

Cyclical

Your typical consumer discretionary stocks, when economy is good or when economy is bad.

– Tours, Hotel, Casino during covid.

– Large ticket items , Properties, Cars

– Luxury stuff like Louis Vutton , Rolex

Timing the cyclicals is hard.

– Rotten -> Mediocore

– Mediocore-> Good

– Good -> Spectacular (Pay attention when )

– Spectacular -> Slowing -> Rotten rapidly….

Wait for prices to get better, capacity to shrink, inventory to go down or scrap price to get better.

Earning will go from lost to huge earning.

Pick those stock that can survive, low risk of bankruptcies :

– Low debt

– Good Cash position

– Good Cash Flow

TurnAround

Very little turn around happens but if you got it right you will hit it big.

Wait and be patient until you see signs….

Some catalyst that might change its fortune.

– Plan to restore corporate earning, new product, new management, cutting cost ?

– Turnaroud take a while so wait for some evidence.

Asset Play

A company with hidden brand asset or some patent drugs . Disney is an example many lands in its theme park with many surrounding hotels .

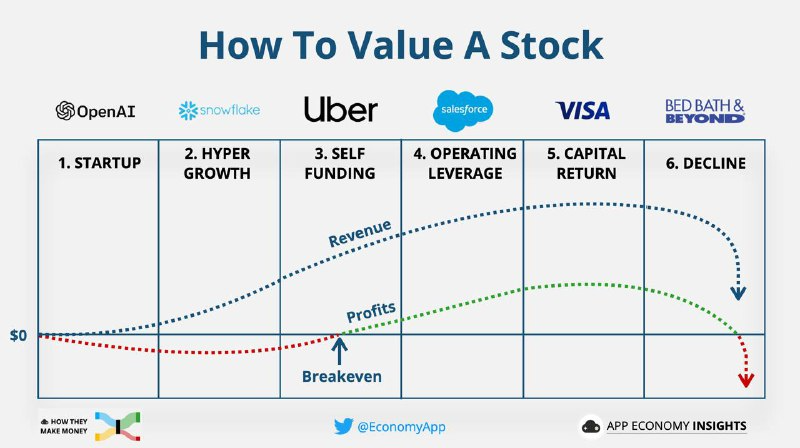

Final Conclusion – Follow The Earning Estimates

How does it plan to make earning rise ?

A long history of earning rise / dividend rise ?

Stock price will mostly follow earning , but earning prediction is hard.

Give a good guess of the story that will impact earning , follow the stories over time.

Hopefully if you hit 6/10 and stocks run up more than 100% , you will do well.