It has been 8 months since i last reviewed the list of fast growers in my stock pick

- Best Mart 360 Holdings Limited (SEHK:2360) ( Best Quality, Best Price… similar to Costco Strategy …. , low margin play of 5-10%)

- IH Retail(1373): Retail stores (they own Japan home in Singapore, similar but many stores in HK and Macau)

- Plover Bay Tech(1523): SD-WAN Router sales. Speciality Communications.

- Perfect Shape(1830):Slimming and beauty Services.

- PAX Global Technology Limited SEHK:327

- Best world ( SGX: CGN ) : A SChip Beauty Darling that shown massive growth and outperformance but was suck into a short seller attack. To date the company has progressed significantly yet remains deep value after its reputation was hurt after short seller attack. It remain an interesting turnaround fast grower play?

- Games Workshop Group PLC

Among the list

Plover Bay Tech , Best World has been the greatest outperformer among the list.

Plover Bay Tech the company that specialised in Outdoor mobile Routers has seen a ROI of 100% , from 2HKD in Jan2024 my last post to 4HKD in Aug2024. This was not taking into consideration dividends that was being payout by the company.

Striking off Perfect Shape. 1830

Despite promising financial numbers on the surface, after more ground up research i have strike off perfect shape from my watch list. The google reviews from the subsidiary and bad overall Glassdoor seems to both a bad management of their employees as well as not being able to give a good service to their customers. It seems like unsustainable growth to me and i will just avoid this company.

Sitting on the fence with IH Retail(1373)

Sitting on the sidelines, the margins remains extremely thin for my liking. At only 5% – 8% operating income margin and inventory turnover of 3.5 , household products just does not seem to be a good market to be in.

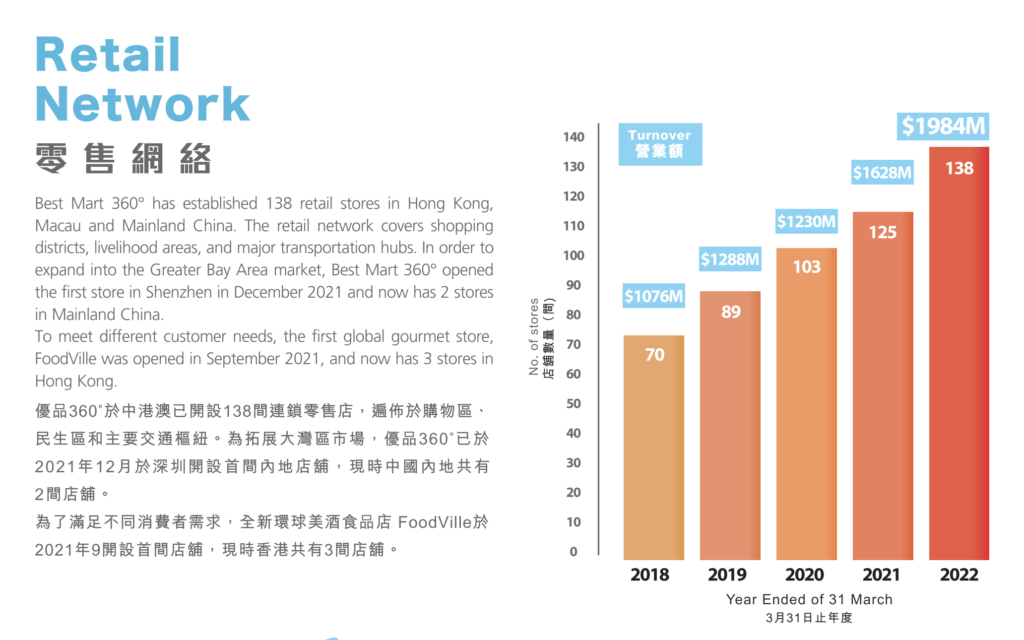

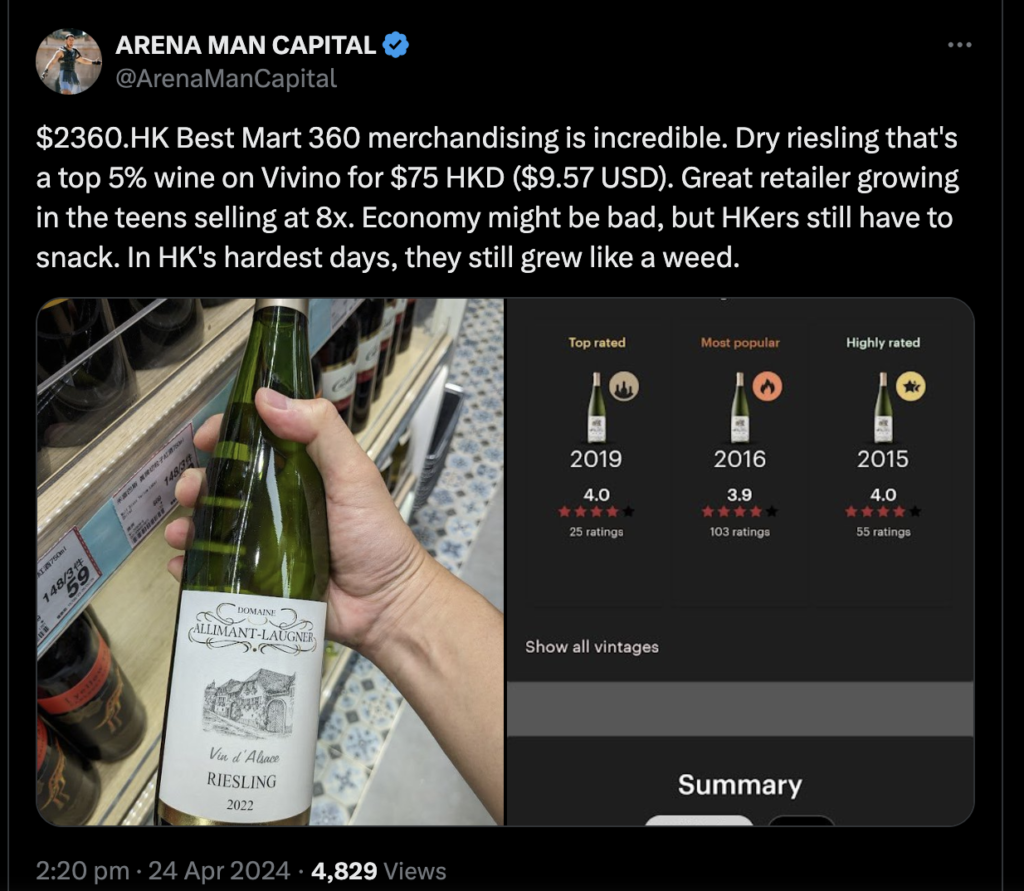

Best Mart 360 Holdings Limited (SEHK:2360)

In comparison to BESTMART360 , the low cost operator that has some resemblance to Costco just seem to do better with improving operating margins from 3% to 11% , and an inventory turnover of 6.5 … BestMart360 seems to strike a chord among the margin conscious consumer and this has allowed it some advantages to move products faster. Food products also move faster than household goods thus might be more superior that IH Retail.

An Expanding list of Exclusive Products and increasing its Retail Network Stores. Its Economic Moats are improving alongside its scale. The company has manage to keep its service quality while scaling up and thats very commendable from a management point of view.

I am keenly looking at this and considering a position in it,

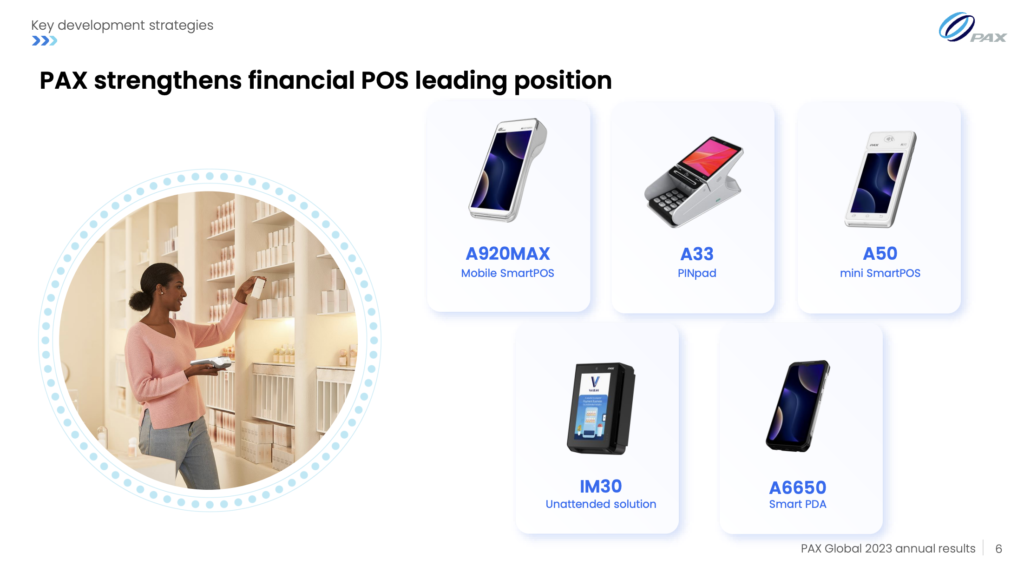

PAX Global Technology Limited SEHK:327

Revenue has fallen quite substantially as a result of a slowdown of the global economy. The company remains an exciting play but as more of a consumer discretionary product i sit on the sidelines as i am unsure how near term earning will play out?